Only with Yettel Sve connect your bank and mobile service and without any fee unlock various benefits such as:

- · 36 GB of roaming data,

- · 90 days of free travel insurance for your whole family,

- · 500 RSD of cash back, and much more.

Only with Yettel Sve connect your bank and mobile service and without any fee unlock various benefits such as:

Everything for your trip

Activate Sve za put and you’ll have 36 GB of data in roaming, along with 90 days of travel insurance for one year, covering your whole family at no additional fee. When you use the code from the Yettel Shopping platform to buy tickets, Air Serbia benefits await you, including:

You don’t have euros in your account? Pay in dinars abroad by card, because you have 2.5% cashback for the first 120,000 RSD spent annually.

Cashback

Check this out: if you connect your bank and mobile service, you get 500 RSD cashback monthly. Only with Yettel Sve you can expect to receive a cashback to your Bank MAX account every month.

Discounts

We’ve selected exclusive offers and discounts just for our Yettel Sve users. Your Yettel Shopping offer isn’t just bigger – it’s better.

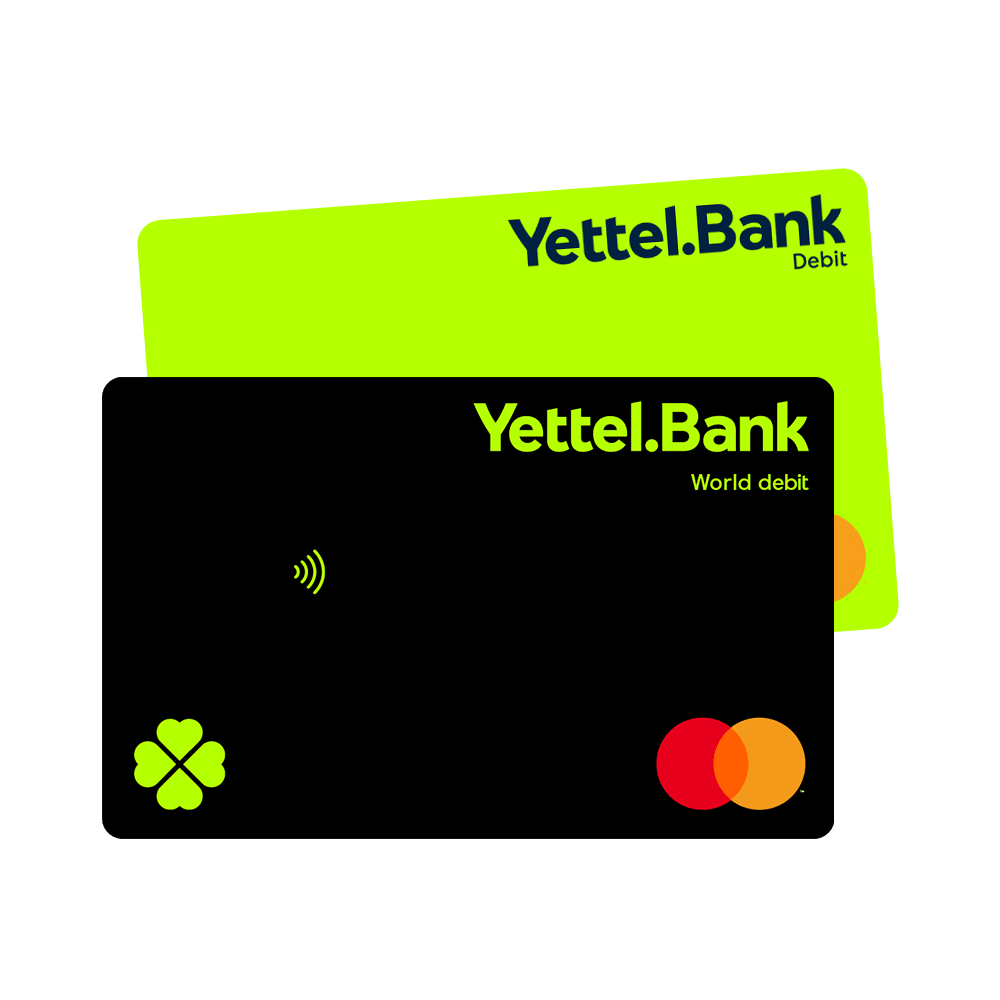

Yettel Sve card

You’ll receive a special Mastercard World debit card from us, which you can use for shopping and online purchases, at home or abroad, and it also brings you special cash back on your travels. You don’t have to wait for it to arrive in physical form; you can use our Yettel Bank Mastercard debit card right away and enjoy all the benefits.

If you are not yet a customer of either company, that's okay. We will work it out together in the next steps.

How do I activate Air Serbia benefits?

When you activate the All for the Trip package, you get access to special discounts and benefits on the Yettel Shopping platform. Here’s how to access them:

All of this will be immediately indicated on the purchased ticket, and later on your boarding pass. Have a good trip!

What are the requirements for Yettel Sve?

*What happens after the grace period?

What do I get with the Sve za put package?

When can I start using the benefits?